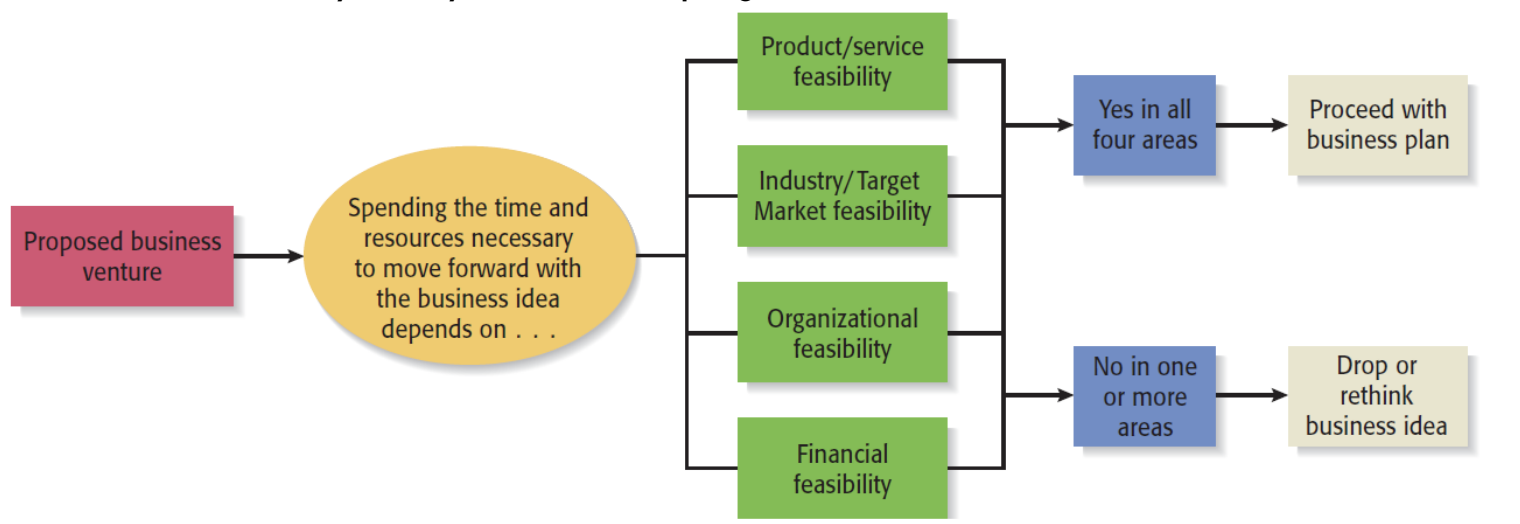

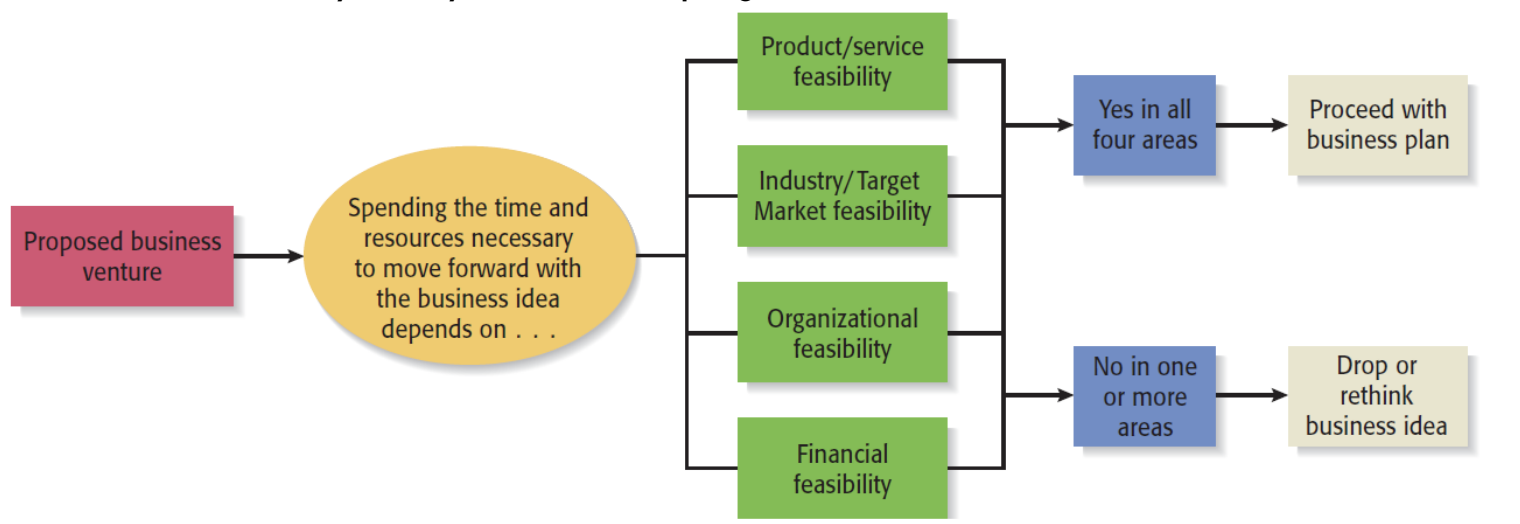

- Feasibility analysis is the process of determining if a business idea is viable

- Proper time to conduct a feasibility analysis is early in thinking

- 4 Types of Feasibility Analysis

- Product/Service Feasibility

- Product/Service Desirability

- Does the product makes sense and solves a particular problem. Will someone be willing to use it?

- Product/Service Demand

- Talking face-to-face with customers to see if you’re making what they actually need

- Using online tools such as Google Keywords etc to understand the current trends and demands

- Surveys and Forums can also help

- Industry/Target Market Feasibility

- Industry is a group of firms making similar products

- Industry Attractiveness

- Younger industries are preferred

- Early in their lifecycle

- Are fragmented rather than concentrated

- Concentrated industries are industries with dominant players

- Are growing rather than sinking

- Target Market Attractiveness

- Find a market that’s large enough for the proposed business but is yet small enough to avoid attracting larger competitors.

- Organizational Feasibility

- Management Prowess

- Ability of an organization’s management team to satisfy the organization that management has the requisite passion and expertise to launch the venture

- Resource Sufficiency

- Availability of space, employee and contractors etc

- Management team and Company Structure

- Should consist of founder(s) and key management persons

- Organizational Chart

- Operations Plan

- How the business will be run and how the product or service will be produced

- Product/Service Design and Development Plan

- If product then prototype should be designed initially

- Financial Feasibility

- Total Start-Up Cash Needed

- List down the resources

- Estimate the Cost of Listed Resources

- Decide about Debt and Equity Financing

- Boot Scrapping

- Process of building a business from scratch without attracting investment or with minimal external capital

- Financial Performance of Similar Businesses

- Estimate financial performance by comparing to similar, already established businesses.

- Overall Financial Attractiveness of the Proposed Investment

- Ability to forecast income and expenses with a reasonable degree of certainty

- Internally generated funds to finance and sustain growth

- Availability of an exit opportunity for investors to convert equity to cash

- Crowd Funders

- Reward based Crowd funding platforms help to raise funding to build a prototype and market test a great idea or product

- If a business idea passes the Feasibility Analysis, the next step is to complete a business plan